Journey Insight 101: How to use journey intelligence

The Journey Insight 101 series

This post introduces Journey Insight and provides an overview of the product, capabilities, and benefits. We’ll dive into the details of the key features in each installment of this series.

What is Journey Insight?

Journey Insight represents a new class of customer journey analytics: journey intelligence. It combines market-level visibility, lifecycle analysis, and competitive context into a single platform.

By analyzing digital journey data from millions of customers in 300+ markets, Journey Insight shows where people research, compare, decide, use products and seek support—and how those patterns differ across competitors.

The visibility gap: Why traditional analytics fall short

You're missing up to 90% of the customer journey

For most brands, 70–90% of a customer’s purchase evaluation happens outside of their owned channels. Much of that journey occurs before they ever visit you, and often ends without ever reaching your site at all. Decisions are shaped by search results, competitor content, comparison sites, reviewers, social discussions, and brand alternatives you can’t measure with first-party tools.

Traditional marketing and customer journey analytics only show a few pieces of the puzzle; Journey Insight fills in the rest.

What brands overlook without cross-market context

Without visibility into competitor journeys or market dynamics, it’s impossible to know:

Where you’re winning or losing users

Which upstream influences matter most

How competitors engage customers earlier

What friction points push users away

Journey Insight reveals the entire customer journey and the market forces shaping it. Teams can make faster decisions, align strategy with real market behavior, and uncover growth opportunities hidden from traditional analytics.

How to use Journey Insight to your advantage

With such a powerful, AI-driven platform and never-before-seen cross-market insights, the potential applications are limitless—but to start exploring those possibilities, you need somewhere to get started.

Journey Insight has a robust set of Market Research Reports. Explore these curated dashboards with interactive data visualizations, or simply use Insight Copilot to ask questions about your brand, competitors, or overall market.

Domain & Brand Search

Search for a brand by domain and identify the markets in which they compete.

Domain and brand search gives you immediate visibility into the competitive landscape around any brand—whether that's yours or one of your competitors.

By searching for a domain, you can see all markets in which that brand appears, the companies they compete against, and how widely their digital footprint extends.

This feature is particularly useful when evaluating unfamiliar categories, researching new entrants, or validating how well a brand is positioned within a market.

Get started with a domain search

Most teams rely on assumptions or incomplete industry lists when analyzing competitors. Journey Insight replaces guesswork with impartial, behavior-based market placement grounded in real user journeys.

Example Insight Copilot questions

What markets does this brand participate in?

Which competitors appear alongside this domain most often?

Is this brand active in multiple categories?

Insight Copilot

Your conversational analyst for journey intelligence.

Insight Copilot transforms Journey Insight into an on-demand research partner. Instead of digging into dashboards or stitching together multiple reports, you can ask natural-language questions and receive clear, contextualized answers supported by charts, comparisons, and narrative summaries.

On-demand data analysis

There's no need to overload your analytics team with an endless stream of exploratory questions or wait for deep dives to interpret data. Insight Copilot accelerates decision-making by making complex market intelligence accessible to anyone, helping marketers, CX teams, and strategy leaders answer critical questions in seconds.

Example Insight Copilot questions

Where do users go before visiting my site?

Which of my competitors has the most loyal audience?

What are the most common journeys across this category?

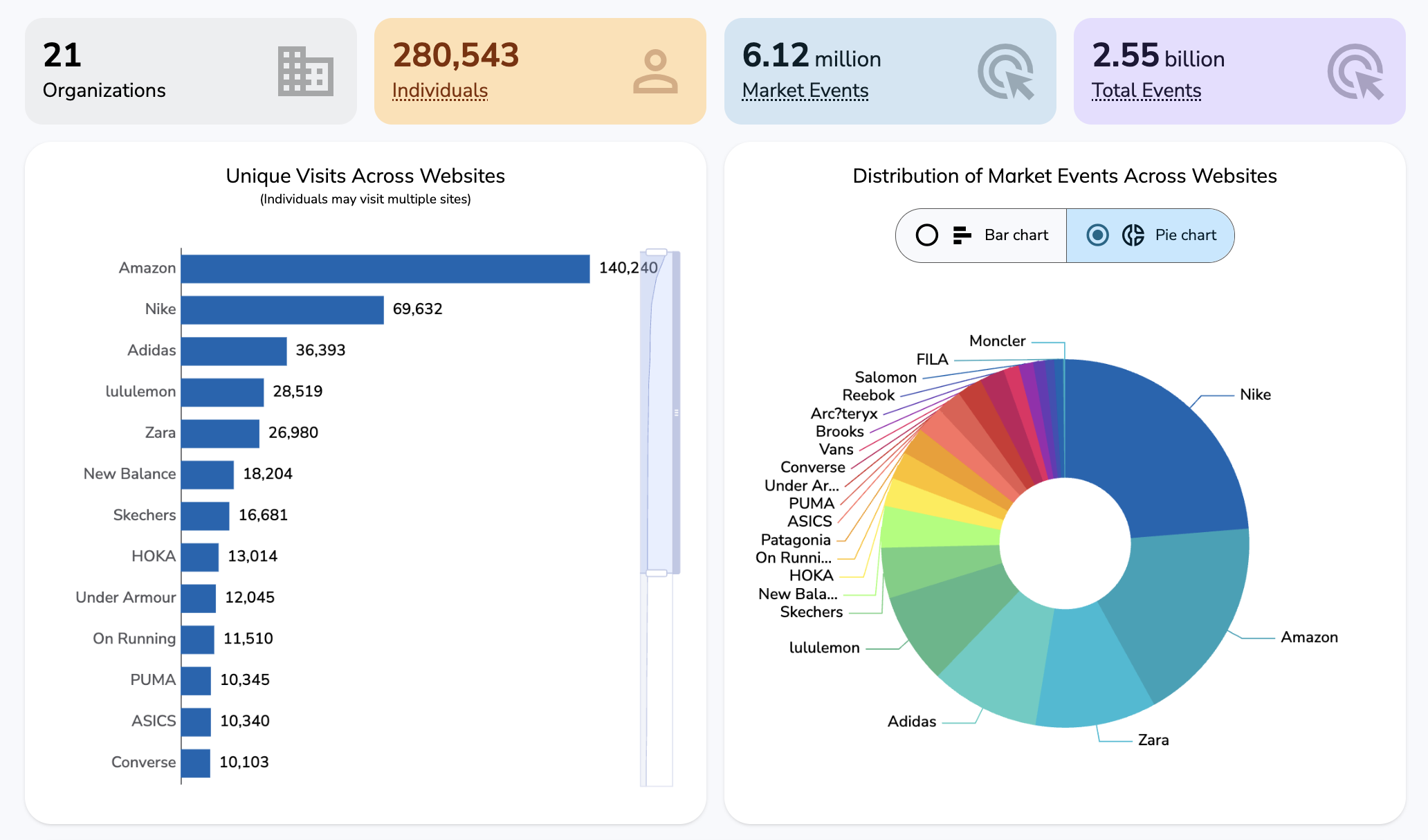

Customer Engagement

Understand market reach, engagement, and competitive scale.

Customer Engagement provides a market-level view of how many users each brand reaches, how deeply those users engage, and how traffic patterns compare across the competitive set. The Web Traffic report in Journey Insight provides volume, audience scale, session activity, event intensity, and engagement depth—all anchored to real customer behavior.

Core metrics for you and your competitors

Website analytics can tell you how your traffic performs, but they can’t show how that performance compares to competitors.

Journey Insight reveals the true scale of the market, enabling you to benchmark your position, identify rising competitors, and understand whether shifts in your analytics reflect market trends or brand-specific changes.

Example Insight Copilot questions

Which brands attract the most unique users?

Who leads the market in engagement depth?

How do my session patterns compare to the market leader?

Market Categories

See how categories overlap, converge, and share attention.

The Market Categories report shows how users move across product or service categories within a market. It highlights category overlaps, where customers divide their attention, and how category-level traffic flows shape competitive dynamics.

Competing for audience attention

Modern markets aren’t siloed; users often compare multiple products, adjacent solutions, or alternative offerings during evaluation. Understanding category interactions reveals whitespace opportunities, convergence trends, and which categories present the biggest threat or growth potential for your brand.

Example Insight Copilot questions

Which categories share the most overlapping users?

Which brands operate across multiple categories?

Is this market converging or remaining distinct?

Brand Loyalty & Crossover

Measure loyalty, overlap, and audience movement between brands.

This report uncovers how loyal users are to specific brands, how frequently they return, and where they go when they explore alternatives. You can identify exclusive audiences, multi-brand usage patterns, and crossover behavior that signals switching or comparison activity.

See which competitors your customers are researching

Understanding when users switch, compare, or split their time between competitors helps you pinpoint retention risks, isolate strong loyalty drivers, and identify acquisition opportunities where your competitors are vulnerable.

Example Insight Copilot questions

Which brands have the most exclusive audiences?

Where else do [brand name] visitors go?

Who shares the most overlapping audience with my brand?

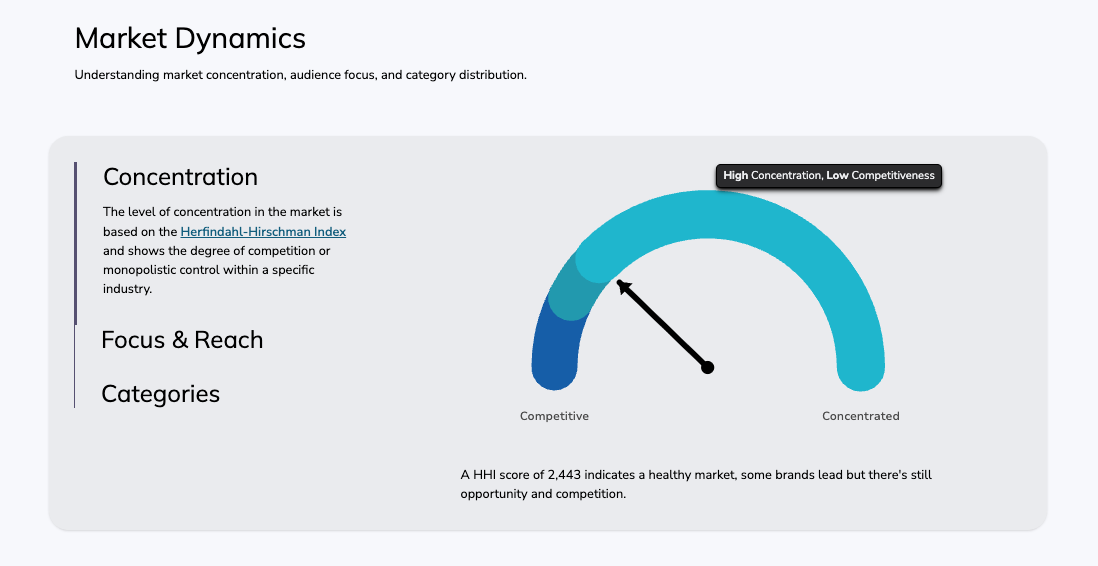

Market Concentration

Assess competitive intensity and discover who truly dominates.

Market Concentration reveals whether a market is broadly competitive or led by a small number of dominant players. It measures share of attention, audience distribution, and competitive balance.

This helps your team distinguish between markets that reward innovation versus those requiring differentiation against well-established leaders.

Inform your go-to-market strategy

A highly concentrated market requires different strategies than a fragmented one. Knowing whether you’re fighting incumbents or tapping into white-space can dramatically change your approach to investment, acquisition, positioning, and messaging.

Example Insight Copilot questions

Is this market controlled by a few brands or broadly competitive?

How much of the market do the top five brands own?

Which brands attract exclusive audiences vs. shared ones?

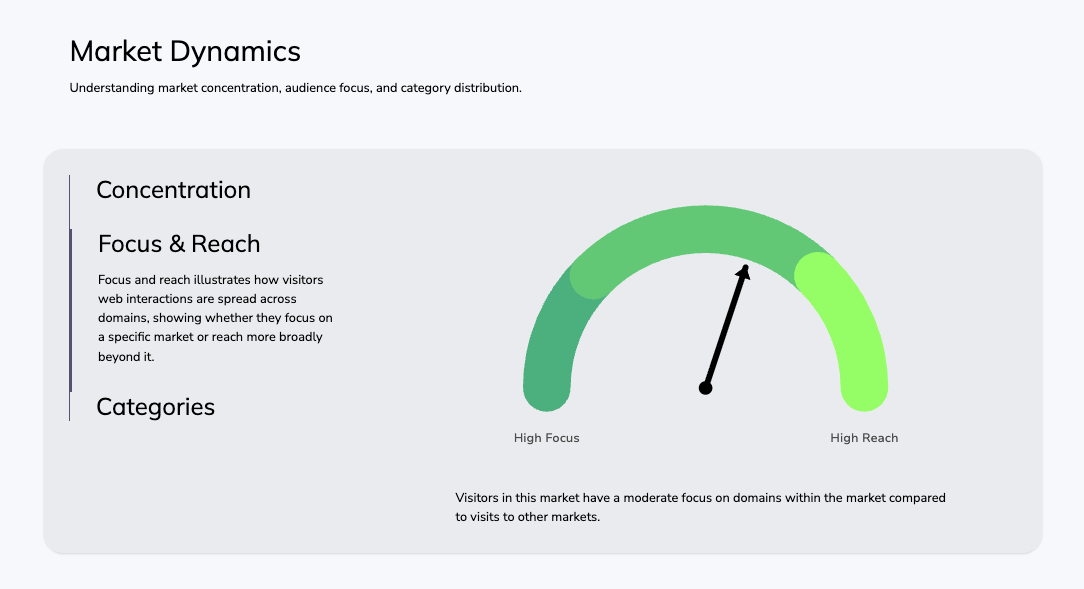

Market Focus & Reach

Understand how deeply users engage within a market and how far their attention spreads.

Focus & Reach helps you assess market penetration. See whether users concentrate their activity within a single market or spread their attention across multiple adjacent markets. It highlights how broad or narrow user engagement is and which brands draw the deepest vs. widest audiences.

Inform your go-to-market strategy

A highly concentrated market requires different strategies than a fragmented one. Knowing whether you’re fighting incumbents or tapping into white-space can dramatically change your approach to investment, acquisition, positioning, and messaging.

Example Insight Copilot questions

How deeply do users engage with this market?

Which brands attract casual vs. committed users?

Do users tend to explore widely or stay focused within a narrow set?

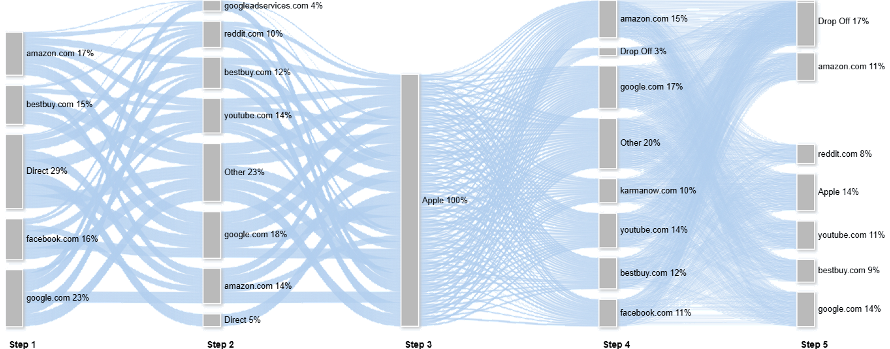

Journey Analysis

Explore upstream influences and downstream behavior across the full customer journey.

Journey Analysis visualizes where users were before they arrived at a brand, where they went afterward, and how they moved across competitors and categories. It allows you to connect search terms, referrals, campaigns, and navigation patterns into cohesive flows.

Your brand is only part of the full customer journey

Traditional analytics start at your front door—Journey Analysis starts long before that, and follows customers once they leave your space, too.

Understanding upstream influences helps you identify missed opportunities, discover key referrers, and see how early-stage perceptions shape outcomes. Downstream behavior reveals retention risks, conversion barriers, and competitor strengths.

Example Insight Copilot questions

What paths do users take before visiting [Brand X]?

Which campaigns or channels drive the most discovery in my market?

Where do users go after leaving our site?

Campaign Research

See how brands reach users across channels.

Campaign Research reveals the actual footprint of marketing campaigns across your market. It shows which channels brands rely on, how diversified their campaign mix is, and which sources drive the most engagement using UTM tags and other data sources.

See where you really need to compete for customers

You may know your campaign strategy, but competitors don't typically share theirs. This feature uncovers where and how your competitors market themselves, which channels produce the biggest reach, and how your campaign footprint compares across the wider user journey.

Example Insight Copilot questions

Where are my competitors running campaigns?

How diversified is [Brand X]'s channel mix?

Which UTM sources drive the most traffic in this market?

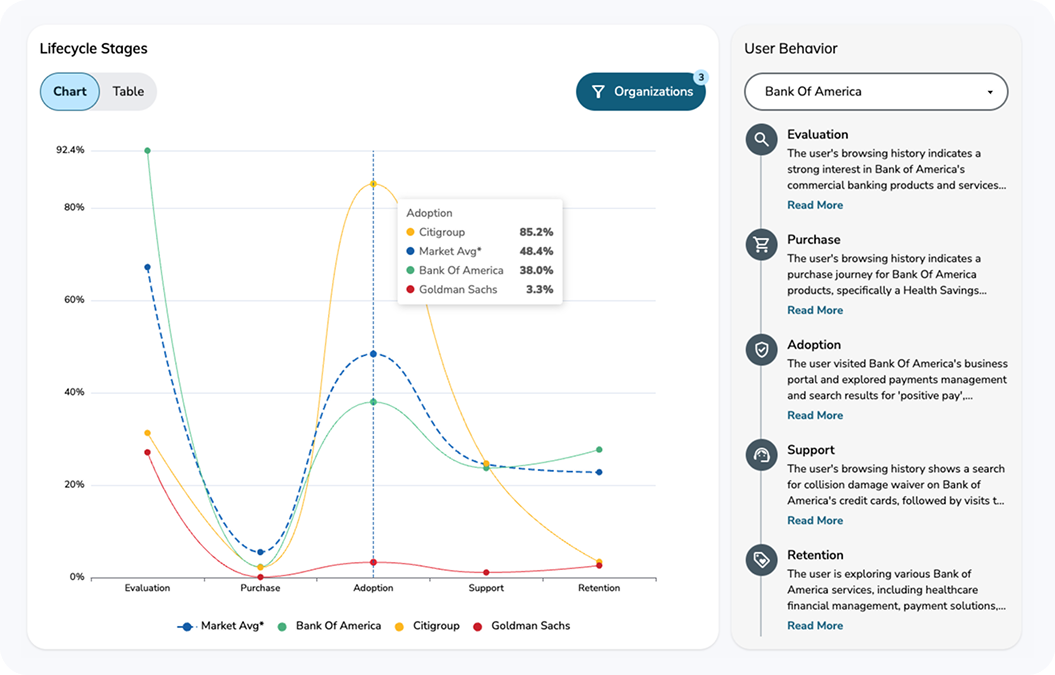

Customer Lifecycle

Understand customer behavior across every stage, from evaluation to retention.

With the Customer Lifecycle report, analyze how users move through different behavioral stages—from initial search-led discovery, to cross-shopping, to repeat engagement and loyalty. These insights are based on real digital behavior, not modeled funnels.

Valuable insights for multiple teams

The Customer Lifecycle analysis is ideal for teams across your organization, including marketing, customer success, and support.

See how users behave during early discovery, when they compare competitors, and when they return to help you shape more effective acquisition, engagement, and retention strategies.

Example Insight Copilot questions

Which brands rely most on search-led discovery?

How do users compare brands during the consideration phase?

Which brands show the strongest retention indicators?

Customer Behavior

Deep analysis of engagement, loyalty, frequency, and multi-brand patterns.

See audience-level behavioral analysis with the Customer Behavior report to analyze how different user types (light, medium, heavy, multi-brand) interact across the market. You can explore metrics like session behavior, event patterns, return frequency, and intensity of use to extract valuable insights and actionable recommendations for your brand.

Refine your strategy to meet different customer types

Not all customers behave the same way. Some compare constantly, some return repeatedly, and some exhibit high-engagement behaviors that signal deeper value. Understanding these segments helps you refine audience strategy, identify high-value users, and benchmark engagement quality.

Example Insight Copilot questions

Which brands have the most engaged visitors?

What's our split between one-time visitors or frequent returning users?

How does engagement differ across light, medium, and heavy users?

Market Creation

Build your own competitive set for tailored benchmarking.

Journey Insight features more than 300 markets and continues to grow with input from our users.

Users in the Premium and Enterprise plans can request the creation of new, custom markets. Define the exact set of brands you want to compare and our expert consultants will configure and process the new dataset.

Whether you’re analyzing a niche segment, modeling a hypothetical competitive landscape, or preparing a pitch, custom market creation enables flexible, scenario-based analysis based on real user behavior.

Free and Professional users are welcome to submit requests for the creation of general new markets. Our team will evaluate the scope and usability of the market to determine whether or not it will be added to the platform.

See what Journey Insight reveals about your customer journeys

Join Journey Insight in a few minutes—no setup or commitment required—or learn more about which features are included in each of our plans.

See the latest CX insights

The new era of journey intelligence

Discover how Alterian’s Journey Insight reveals the 70–90% of customer journeys brands can’t see—transforming hidden behavior into actionable intelligence.

Unlocking customer experience success with Journey Insight

Explore CX priorities, real-world case studies, and see how Journey Insight uses behavioral and competitor data to cut churn, boost ROI, and optimize digital experiences.

Mastering customer journey management in 2025

Learn how to overcome roadblocks and prove ROI for essential journey management, maximize the potential of customer journeys, and deliver exceptional customer experiences.