GEO isn't just SEO for AI—it's a competitive strategy

Key takeaways

GEO is a competitive strategy shaped by how generative engines synthesize, compare, and select brands.

Brands now compete to be surfaced and chosen inside AI-generated answer sets.

AI-driven journeys are more complex, not shorter—introducing more touchpoints, more competitors, and more moments of validation.

Market-level journey visibility is essential to understand where AI influences consideration, comparison, and purchase decisions.

Generative Engine Optimization is critical to competition

The phrase “SEO for AI” has become shorthand for Generative Engine Optimization (GEO). It’s neat and intuitive, but it oversimplifies a much bigger shift.

Traditional SEO was built around rankings, links, and traffic. GEO operates at a deeper level, shaped by how large language models (LLMs) are trained, how they synthesize information, and how they decide what meaning to surface. In a generative environment, brands don’t compete for rank. They compete for relevance, credibility, and inclusion.

You don’t “rank”—you’re interpreted.

Tools like ChatGPT have changed consumer behavior

To illustrate this concept, we analyzed customer journeys from a panel of 35,000 active beauty consumers. The data shows that generative AI platforms like ChatGPT aren’t just intercepting search queries. They’re quietly reshaping how consumers navigate competition itself—how brands enter consideration, how alternatives are evaluated, and how confidence is either reinforced or eroded before a purchase decision is made.

For marketing and CX leaders, the challenge isn’t just visibility. It’s credibility once comparison begins.

Visibility vs. selection

How generative AI synthesizes and prioritizes brand information

Search optimization has long followed a familiar logic: improve rankings, attract clicks, convert visits. Generative engines don’t work that way.

Instead of surfacing lists, they generate conclusions. They pull from multiple sources at once, collapse nuance into synthesis, and prioritize what appears broadly useful over what is most aggressively branded. The result is something closer to a perceived market consensus—and that can be uncomfortable for brands used to controlling their own narrative.

What journey data reveals about AI-driven brand selection

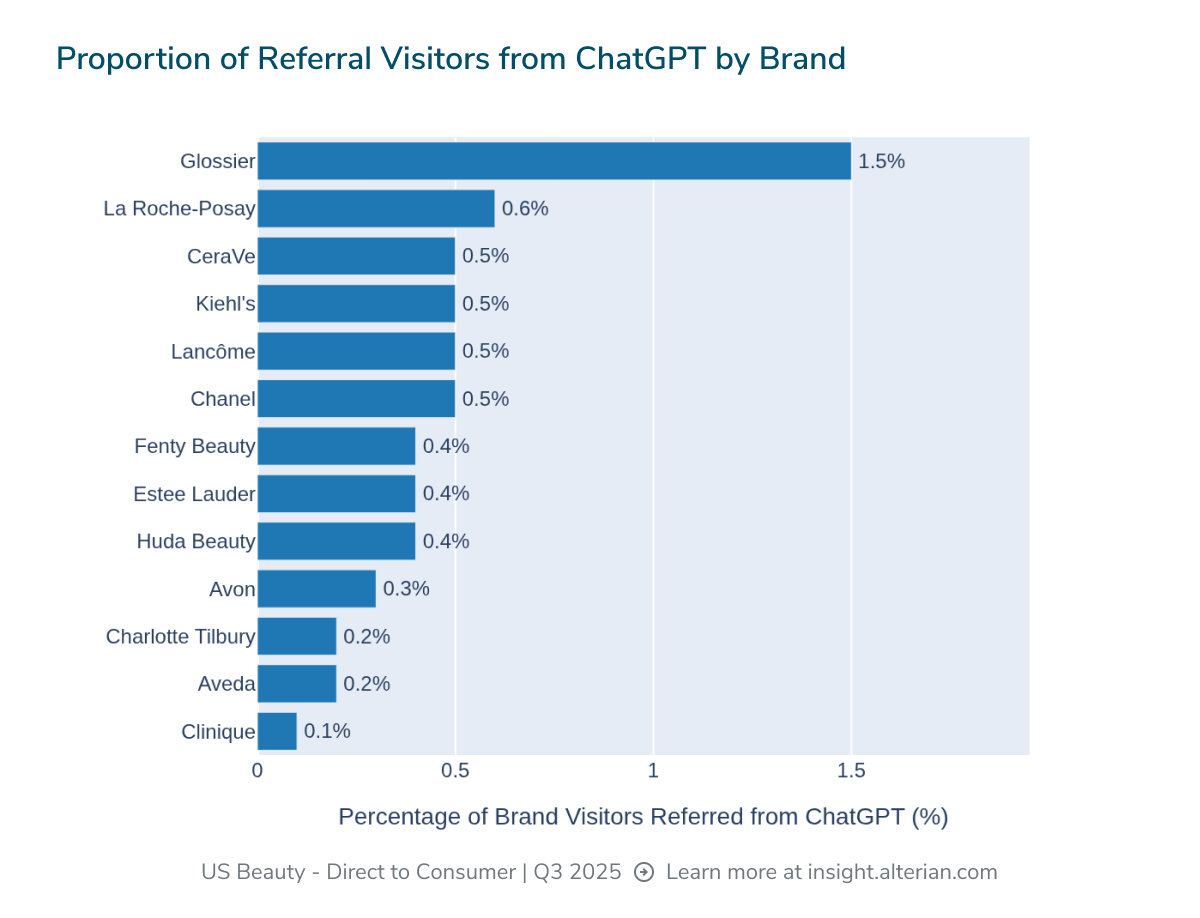

That shift is visible in the data. Among beauty brands, the companies with the largest overall digital audiences aren’t always the ones cited most frequently by generative AI. In many cases, AI surfaces smaller or more specialized brands whose positioning aligns more closely with the question being asked.

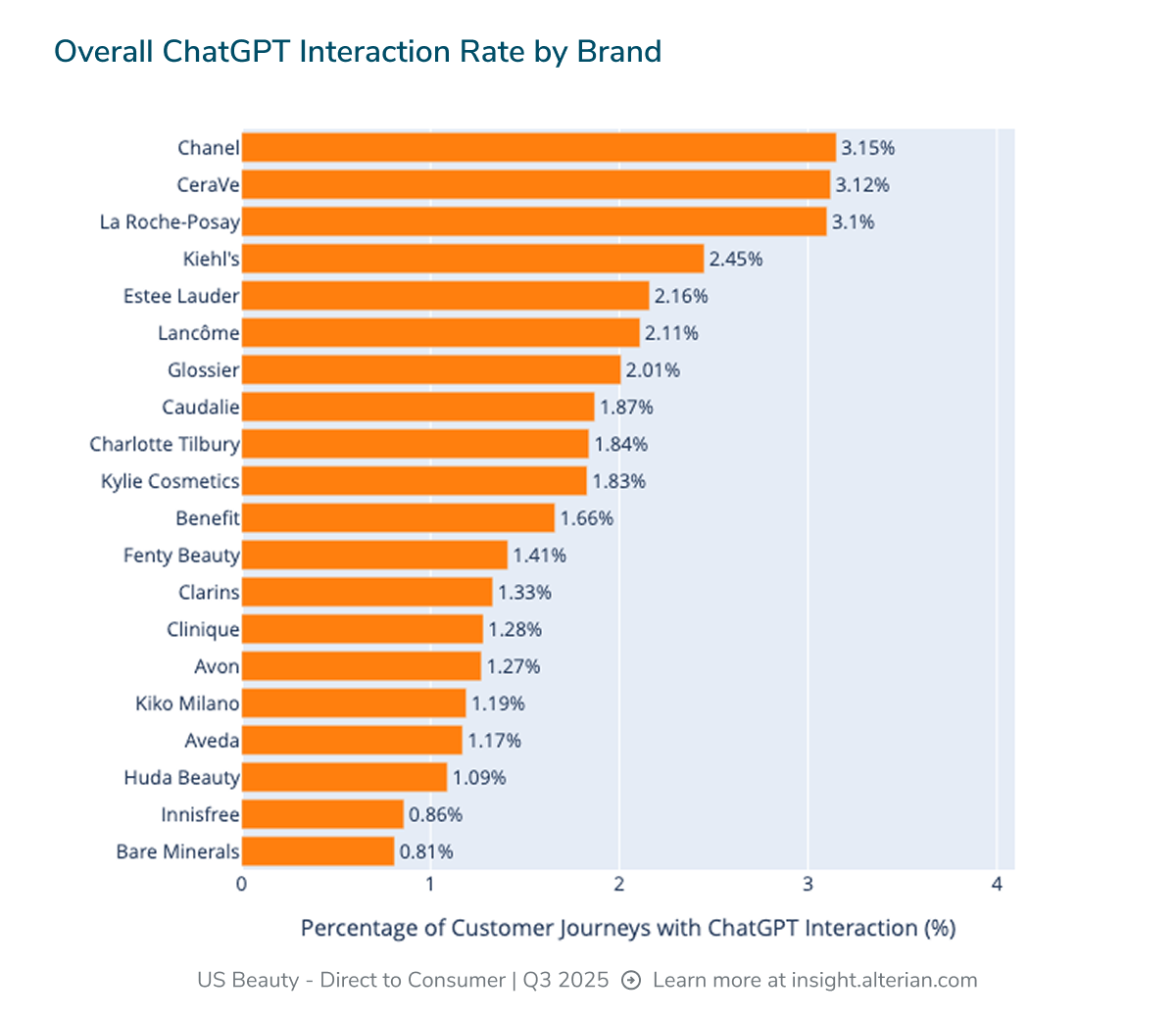

When we look at the overall interaction rate by brand, ChatGPT appears at some point in the customer journey for each. Consumers are using it to research, compare, and ask questions about the brands and products.

Both Chanel (21%) and CeraVe (8.9%) hold a larger portion of the panel market share by total visitors than Glossier (7.2%). Still, Glossier gets 3x more visitors referred by ChatGPT (1.5%) than either larger brand:

The competitive battleground has moved. Brands are no longer competing for position. They’re competing to be included—and then chosen—within an AI-generated answer set.

The explosive growth of ChatGPT influence in journeys

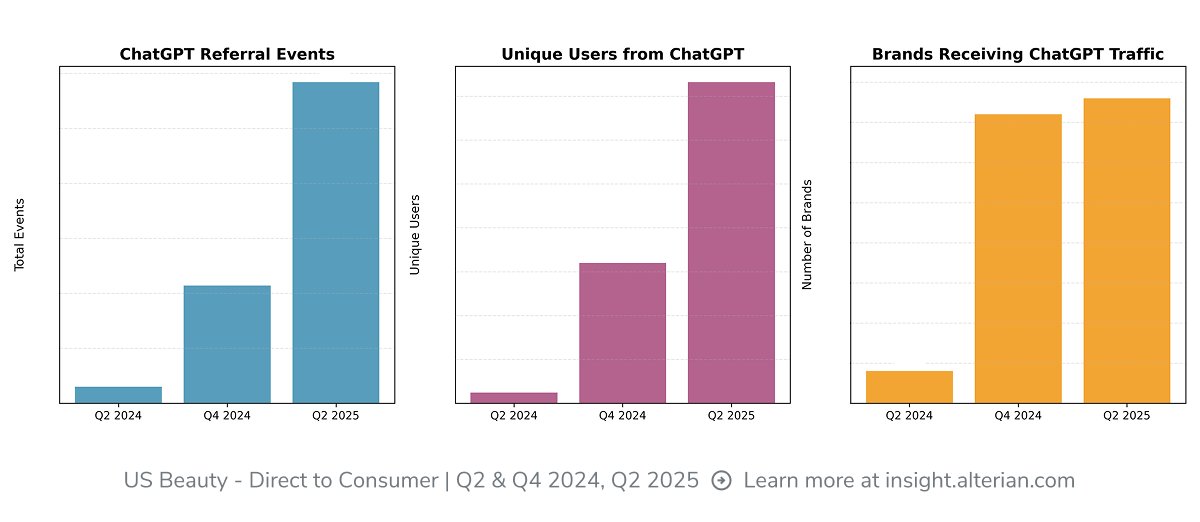

Between Q2 2024 and Q2 2025, ChatGPT referrals within beauty journeys increased 19x. Over the same period, the number of unique users engaging with ChatGPT during those journeys grew nearly 30x. What was once a marginal traffic source has become a recurring layer in the decision process, appearing before brand visits, during evaluation, and, crucially, even after consumers have already engaged with a brand.

While ChatGPT accounts for 14.14% in the latest quarter of data, referrals in the US beauty market are still dominated by search engines (42.3%) and direct traffic (50.85%). Yes, AI is still smaller traffic source in the ecosystem today—but the pattern of exponential growth over an 18-month period is staggering.

This isn’t channel substitution. It’s significant behavioral change for consumers, and a clear signal for brands to adapt.

AI hasn’t shortened (or simplified) customer journeys

Early optimism around generative AI assumed it would compress decision-making by reducing friction. The journey data tells a different story.

AI-assisted journeys introduce more touchpoints, not fewer

Nearly half of journeys involving ChatGPT included three or more touchpoints. Among journeys without AI, fewer than one in four reached that level of complexity. Overall, AI-assisted journeys were more than twice as complex.

Q4 2024 | Q4 2024 | Q2 2025 | |

|---|---|---|---|

Market presence | Minimal | Emerging | Mature |

Role in journey | Simple referral source | Discovery + bridge | Discovery + validation + comparison |

Journey complexity | Single-step only | Two-step patterns emerging | Multi-step, circular patterns |

Brand leadership | Chanel monopoly (93%) | Chanel + Glossier co-leadership | Shared leadership across 5+ brands |

User behavior | Linear | Sequential | Iterative |

Proportion of direct referrals | Not meaningful | 0.01 – 0.07% | 0.10 – 1.32% |

Consumers using AI don’t move faster. They look harder.

They introduce more brands into consideration, validate claims more frequently, and revisit decisions after moments that once marked the end of evaluation. AI lowers the effort required to re-check alternatives and reduces the cost of second-guessing.

This means GEO isn’t about outperforming a keyword. Brands have to hold up under sustained comparison, often against competitors that wouldn’t have shared the same funnel in a pre-AI world.

Where GEO really influences the customer journey

Another assumption worth retiring is that AI’s influence is limited to discovery.

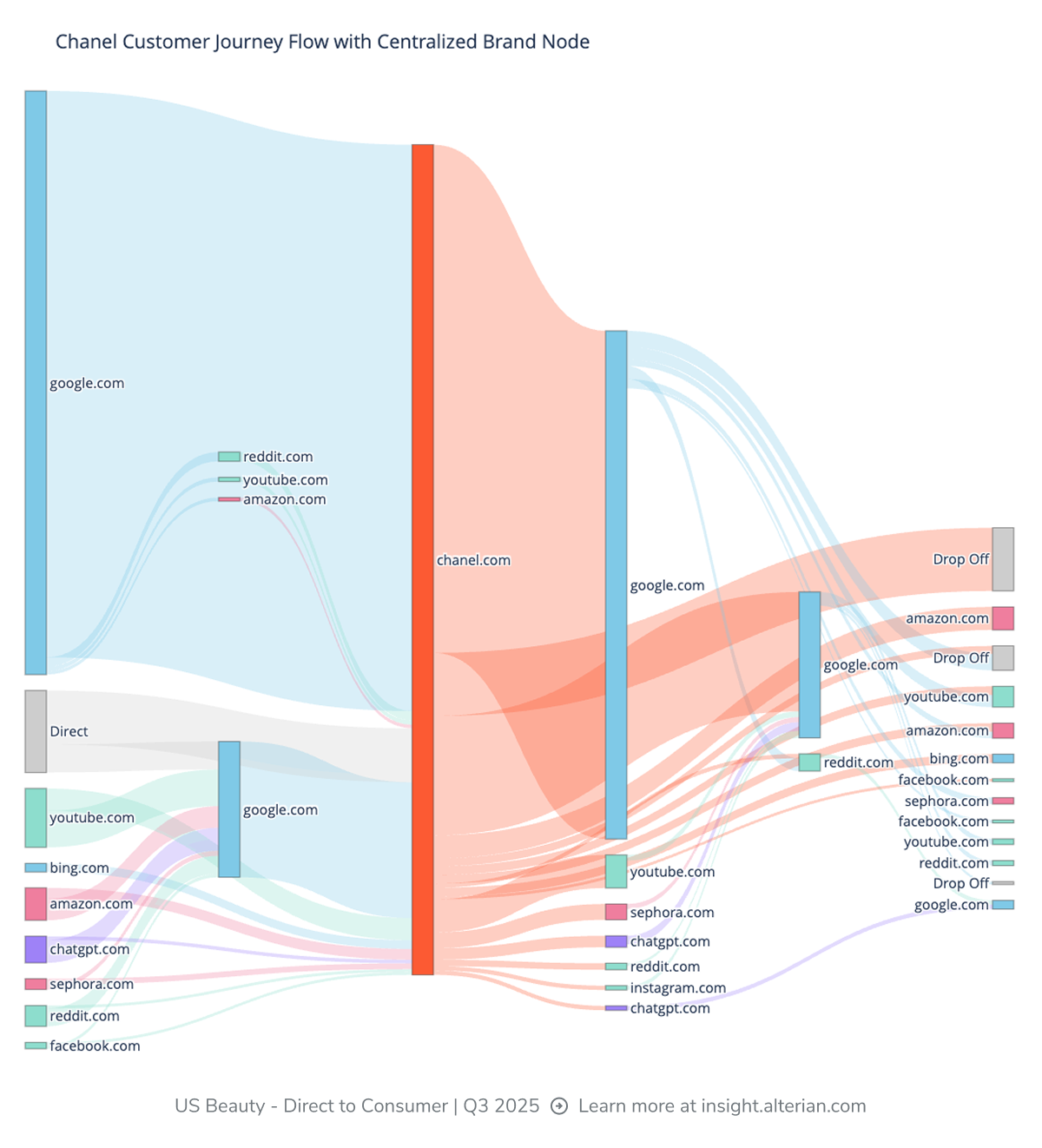

In Q2 2025, roughly 63% of ChatGPT interactions occurred before a brand visit, as consumers clarified category expectations and narrowed down options. But 37% occurred after a brand visit—when shoppers were seeking reassurance, comparing ingredients, questioning pricing, or asking whether an alternative might be “better.”

What luxury brand journeys reveal about post-visit AI influence

This is especially clear amongst luxury and prestige brands. Their journeys often looped from brand to AI and back again, sometimes repeatedly. A site visit no longer signals the end of evaluation. In many cases, it intensifies it.

This creates two distinct points of vulnerability:

Before a brand visit: AI determines who enters consideration

After a brand visit: AI helps decide who stays there

Optimizing only for discovery leaves the second—and often more decisive—moment exposed.

Retail behavior underscores the stakes, even for major brands

Consumer interactions with Chanel illustrate this dynamic well. On the surface, Chanel appears insulated from disruption: strong brand intent, substantial direct traffic, and a dominant search presence. Yet the journey data tells a more nuanced story.

AI appears early in the Chanel journey, not as a primary source of traffic, but as a framing mechanism. When AI reintroduces comparative context around value, innovation, or suitability, retail exits increase by nearly 30% after a Chanel brand visit.

Even the strongest brands are being quietly reevaluated.

Why GEO fails without competitive insights and market context

Most GEO efforts today focus on technical optimization: clearer structure, stronger FAQs, more explicit authority signals. These are important, but they’re incomplete.

AI-assisted users are more deliberate, more comparative, and less likely to abandon a journey once engaged. What determines outcomes isn’t just clarity, but the competitive context AI constructs around a brand.

Competitive journey intelligence reveals where AI introduces alternatives, where hesitation is triggered, and where post-visit validation either reinforces or undermines differentiation. Without that visibility, GEO is a surface-level exercise disconnected from how consumers now make decisions.

The strategic implications of GEO for modern marketing teams

GEO isn’t a passing optimization trend. It reflects a deeper shift in how consumers process choice in an environment of abundance.

Organizations that treat GEO as a tactical extension of SEO may optimize content and still lose consideration. Those that treat it as a strategic capability, grounded in real journey behavior and competitive exposure, can influence how AI-driven decisions unfold.

Get market-level journey visibility with Journey Insight

Generative AI is already reshaping how customers discover, compare, and decide.

Journey Insight helps you see where AI enters the journey, which competitors are being introduced alongside you, and where confidence is reinforced or lost. With market-wide journey intelligence and Insight Copilot, you can identify real GEO opportunities, understand how AI influences selection at every stage, and adapt your strategy based on how decisions are actually made—not how you assume they are.

If AI is quietly influencing who gets chosen, Journey Insight shows you where to act.

Get free insights on your customer journeys

Sign up for our robust Free Plan in just a few minutes.

See the latest CX insights

Hospitality brands can't see 85% of the customer journey

Travel & leisure analytics only show 15% of the customer journey. See how travelers move across OTAs and competitors—and how Journey Insight reveals what your dashboards can’t.

Banks are losing control of the customer journey with AI search

GEO, zero-click search, and AI-driven comparison shopping are reshaping personal banking. See why banks now control less than 30% of the customer journey—and how to adapt.

How AI has changed customer journeys (and why most brands can't see it)

AI tools like ChatGPT are reshaping how customers discover brands. Learn why most journeys are invisible—and how market-wide insight changes strategy for GEO.